|

|

|

|

| Saturday, January 29, 2022 - 05:17 am For my enterprise (Emerithe Corp on WG) I bought 125 boosters to build 3 corporations per day. I am very happy I am at the end. This was very costly. I had to buy 2 free countries, so I could liquidate their valuable military assets and pour the money into my enterprise, so it wouldn't go broke. Even with that, many times my debt has gone to 7 or 8 trillion. I would like to thank The Union States of America for loaning me the bulk of the money I used to build my enterprise. Emerithe Corp nets around 300B/month (~1.8T/rl-day) from 541 corporations, so hopefully I will have all loans paid off in a week or two.

| |

| Saturday, January 29, 2022 - 11:19 pm I hate to break it to you but your enterprise is reporting 330B/month profit before C3 and enterprise taxes, but that doesnt mean it actually makes that profit, let alone cashflow on enterprise level. Your enterprise this month: Cashflow statement Last Month Cash -131.64B SC$ Interest Paid -0.13B SC$ New Loans Taken 120.00B SC$ Corporations bought, closed or moved and Enterprise Tax -112.64B SC$ Cash Transfers To and From Corporations -100.00B SC$ Profit Payments and Cash Transfers 199.20B SC$ Cash Available -25.21B SC$ P&L Total Profit 323.66B SC$ Look at profit payments. It is reporting 199.2B after C3 tax. But also a 100B deduction due cash transfers The reported profit of 323B is calculated by settling all profits (positive and negative of all corporations) before C3 taxes. >> If you build in C3s you need to deduct 30% of it due C3 taxes. But your enterprise is cashflow negative, due the way total profit is reported. >> For example. Lets say 400 corporations make a total profit of 470B before C3 taxes. It will add up 470B at the reported Total Profit. Lets say 147 corporations make 147B loss, it will be deducted from the reported Total Profit. It would report: 470B minus 147B = 323B Total Profit. If you take 30% C3 tax of that, you would think you pay 97B C3 Tax, but in reality you pay 30% over 470B = 141B C3 tax, because you dont get a tax deduction of the loss making 147B of the 147 loss making corporations. The Total Profit reported is therefor not saying much, because you dont know how much you make after C3 taxes consolidated. Look at your cashflow statements. You probably have profit transfer at 86 (seems to be calculated based on corp cashflow??, not sure) and it paid you 199B. Enterprise tax is 113B, meaning you had 86B of profit payment/cashflow after enterprise tax. But you also had a automated cash transfer of 100B due your loss making corporations, meaning 14B of negative cashflow on enterprise level. If you really have profit transfer at 86 you left 32B in your profit making corporations, meaning you could bump it up to 14B positive, added with the 100B going to loss making corporations, you made 114B positive cashflow consolidated, but 14B on enterprise level. Congratulations! This correspondents somewhat with your cash balances. I rounded somewhat. But you had -131.64B cash, took out a loan (automated) of 120B, and your cash ended with -25.21B, meaning it grew 106,43B, but 120B due loan, so without it it would have grown 13.57B. And no, this is not your fault, the enterprise game is broken, has been addressed multiple times here on the forum. They should at a line where Total C3 taxes paid is reported. With that information, and combined with enterprise tax, you can calculate your actual tax rate, which is probably high, especially if they add "country resources used fee" to it as well... Btw. Dont buy free countries with GC for some spare cash. If you build 110 natural resource corporations in ceo, financed 7T with debt, 4T with own equity, you can IPO them after 2-3 weeks for 70T-110T. With 60GC, using the same boosters also as registration extensions, you can collect around 300T+ in 2 months with it.

| |

| Sunday, January 30, 2022 - 12:14 pm Congratulations. this is a huge number. are these corporations all upgraded to the max? We look into enterprises. there are some that make several Trillions per game month. Much of the profit stays in the corporations. You should check the assets curve too, to see how the enterprise is doing. It is not trivial to make enterprises very profitable but somehow, players with large enterprises are the richest in Simcountry. Enterprises pay a lot to the countries where the corporations reside, many reside in the countries associated with the account. and where are these cash transfers going? Loss making corporations obviously do not pay taxes and when they become profitable, the tax payments are computed over the previous period and averaged and in fact, they do not pay any taxes for some time until the average income over a longer period becomes positive. Many players did the math in the past years. we used to have many complaints. with time, corporations became more profitable and the situation changed. Probably some concluded that the enterprise game does not make sense, some concluded otherwise and are making money.

| |

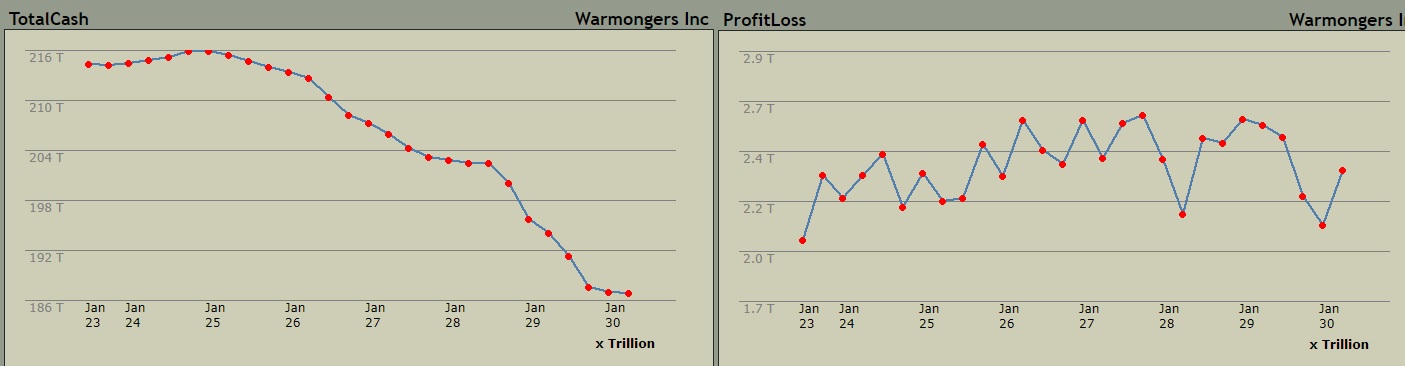

| Sunday, January 30, 2022 - 01:53 pm CEO game is very much hurt by Enterprise tax, which is calculated from turnover but not from the profit after all taxes corporations pay to countries. Enterprise tax is also additionally calculated from Enterprise profit share. the only logical solution would be to remove it at all or start calculating it from the profit after all taxes paid to countries. I am seriously considering closing my largest SC CEO as during 1 real year I I was unable to earn anything with it. Majority CEOs I check are also doing very bad. here is the proof of the last 1 real month:  with the recent changes in country sizes the 500M country will have 1000 or more corporations potentially earning 800-1000B per game month - keeping all profit, also in empire you could have many of such countries. So why people would try this CEO nightmare with corporation number limitation and impossible taxes when simply having 1 big country is much more profitable. Not even talking about other benefits country has over CEO gameplay. This Enterprise tax is by far the most unfair feature in the game.

| |

| Sunday, January 30, 2022 - 08:13 pm Mndz, it is not just enterprise tax, it is the way C3 tax is taxed as well. I took a quick look at your enterprise, and I roughly estimate currently about a third of your corporations are not profitable, due underhiring, lack of supplies, surplus of output product or just not profitable due max pricing like some of your assets maintainence corporations. You have 5593 corporations which should on average generate 0.85b profit before C3 taxes. Assume 3725 corporations you have generate this profit, meaning total profit of 3166b. The other 1868 is generating losses, probably on average 0.5b per month, meaning a total loss of 934b, which gives you a (consolidated) total reported profit of (3166 - 934) 2232b per month. If your enterprise was just 1 big corporation, it would pay 30% tax of 2232b, which is 670b, but instead you pay 30% of 3166, which is 950b (41% higher). You pay 932b enterprise tax, but you have 915T military assets of 3157b assets, which is 29% of total, so 71% non-military assets. So lets assume you had no military assets, your enterprise tax would be 71% of 932b, which is 662b. So your total tax rate would be (950b+662b) 1612b of 2232b total profit = 72.2% tax rate plus country resources used fee.

| |

| Sunday, January 30, 2022 - 08:53 pm it is true and on top i pay country resources tax even when making loses. no logic here. i count like that - i would earn 1b/game month with normal corporation controled by country, but in ceo i pay 30% something as a resource fee then from the remaininf profit i pay 30-75% country tax and 30% enterprise tax on top, which adds to 70-90% tax from profitable corps. then i need to support the ones that are not profitable and losing money. not fair as i said as country gets everything without any penalty. rhis caused many big players to leave ceo when realizing this nonsense.

| |

| Wednesday, February 2, 2022 - 01:53 am From what it sounds like, my enterprise is SOL and other than funneling more money into it there's not much I can do about it to make it profitable. OK, I can accept that. I don't want it if it's going to be a money pit even when most of the companies are money makers. Once I get my reward for #1 enterprise, I'm going to figure out how to close it.

| |

| Wednesday, February 2, 2022 - 03:13 am You dont have to close your enterprise, just keep in mind that building corporations and keep them is not (much) profitable. However, enterprises do have utility value imo: 1 You can privatize your state corporations without handing over control to AI wich tend to perform. Private corps are more efficient. Tax at 75. 2 You create military corporations to produce military assets that are in large shortage. 3 You can IPO corporations to raise cash. Some defense corporations with large shortages tend to lend them very good for this from time to time. 4 Enterprises are needed for higher gamelevels, to achieve higher scores, to claim awards.

| |

| Monday, February 7, 2022 - 01:09 pm Lord Mndz, What's your profit transfert? What's your selling strategy? Cause I dont have problem making money with my enterprise and I only have 75 compagnies... Yes I dont rack that much money, but I'm profitable every month.

| |

| Monday, February 7, 2022 - 01:32 pm Lord Mndz, I've check some compagnies on your FB enterprise and I will agree with Neutralsc, you need to fix employement. Some of your compagnies have 150 salary index. C3 are starting at 300 index and I personnaly use 400 for most of my compagnie, so I dont have problem with employement. Your hiring index is at 83%, that's pretty low. For your trade strategy, I dont understand something... Probably Andy can answer this one :P. Mndz, you are using 295 with a -1% per month. I'm using the quality +200% and I barely make more money then you... Why? I'm selling 200% higher with the same quality, but still it doesnt show up on the sell price... Here 2 corps for an exemple : Mine : https://sim02.simcountry.com/cgi-bin/cgi2nova?SN_ADDRESS=wwwCountry&SN_METHOD=ccorp&miCorpNumber=6015024 Mndz : https://sim02.simcountry.com/cgi-bin/cgi2nova?SN_ADDRESS=wwwCountry&SN_METHOD=ccorp&miCorpNumber=365001

| |

| Monday, February 7, 2022 - 03:58 pm Demerzel, you need to look closer before thinking you know what and why  150 salary is only for corporations placed in my own countries. this allows me to save 1T per game month in salaries regardless of loss in production. the rest have 300 salaries as default in c3 is 297. 150 salary is only for corporations placed in my own countries. this allows me to save 1T per game month in salaries regardless of loss in production. the rest have 300 salaries as default in c3 is 297. trading strategies are broken, if you check selling prices you will see that majority of the orders are executed at the same percentage as product quality level. this is a bug which needs to be fixed by w3c. i will post is one day on the forum as it requires proof for Andy. the major thing that you dont understand is that my ceo is super large and is being penalized by enterprise tax. i am paying around 1T even if my ceo losing money. my profit transfer is 0, i only get money when corporation has surplus and transfer back to Ceo. if i increase profit transfer that would further increase an enterprise tax.

| |

| Tuesday, February 8, 2022 - 08:07 am Mndz, I thought profit transfer at 100 would decrease enterprise tax, due lower market values. What do you know that I dont?

| |

| Tuesday, February 8, 2022 - 11:39 am I tried 100% but the enterprise cost got almost double. many corporations are placed in my countries with 75 country tax so i would not feel the difference in value probably. Also are you sure that ceo profit transfer will reduce the value of corporations, I canot recall that.

| |

| Wednesday, February 9, 2022 - 08:51 am Yes im sure about market value, because profit transfer affects net profit. Not how it should be but it is the way it is. I play with market values due profit transfer in my ceos all the time in order to meet the IPO criteria.

| |

| Wednesday, February 9, 2022 - 06:53 pm Both the enterprise tax and the contribution corporations pay to the country where they reside depend on turnover and on profits. Country contribution is not paid if the corporations make loss. However, corporations now are not what they used to be. Many are larger and their profits, although larger than in the past, are probably a smaller percentage of their turnover. We will review both. The contribution to the country is essential and it makes such corporations attractive to the presidents. We just need to have another look at the moment the corporations start to pay them and make sure they never pay when there is a loss. The loss is for each corporation separately so some pay and some do not. The enterprise tax is less obvious and the growth of corporations might have contributed to the level of the tax. I think that an enterprise with less than 300 or 400 corporations should not pay any tax. We have designed the enterprise game for max 750 corporations. Obviously we did not block higher numbers but the limit from our point of view remains 750. I will try to review the relevant code in the coming days and get back here with some results.

| |

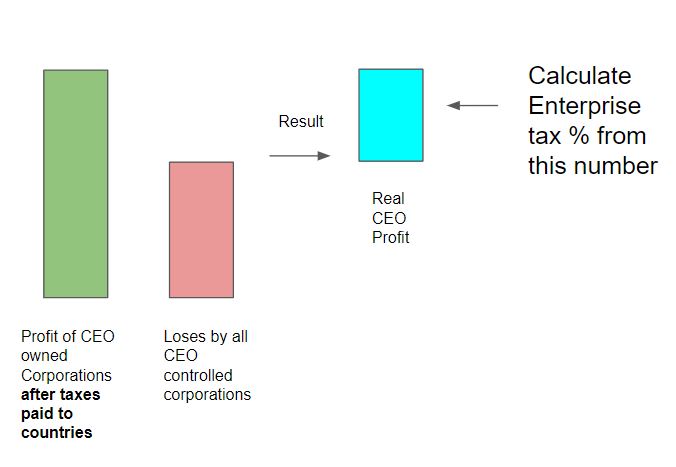

| Wednesday, February 9, 2022 - 09:36 pm Hi Andy, Please see the attempt below to show what is the real profit of CEO. Enterprise tax should be calculated from the light blue box.  just please take in your consideration the fact that some countries now have 750 and more corporations >800 corporation and are not penalized in any way. Why CEO need to pay all the taxes to countries and still to be penalized while countries get all the profit. Playing in peaceful mode these countries take no risks while getting many times higher profit than CEO with thousands of corporations. This is insane disbalance between these two roles and they both cost the same amount of Gold coins.

| |

| Thursday, February 10, 2022 - 05:56 pm Need to make sure this idea is scaled for percent owned for public corps.

| |

| Friday, February 11, 2022 - 12:26 pm agreed, thanks for input

|